- Revenue: Record $135.9 million, a 44% year-over-year increase, aligning with analyst estimates.

- Gross Profit: $8.6 million, a significant improvement from the previous year’s loss of $17.3 million.

- Net Loss: Reduced to $151.8 million from the prior year’s $164 million, showcasing a narrowing loss.

- Cash Balance: Ended the year with a healthy cash balance of $71.7 million.

- Backlog: Substantial backlog of $2.7 billion, indicating strong future revenue potential.

- Capital Expenditures: Increased slightly to $23.1 million in 2023 from $22.5 million in 2022.

- New Contracts: Secured over $2.7 billion in new awards, representing more than 360 satellites.

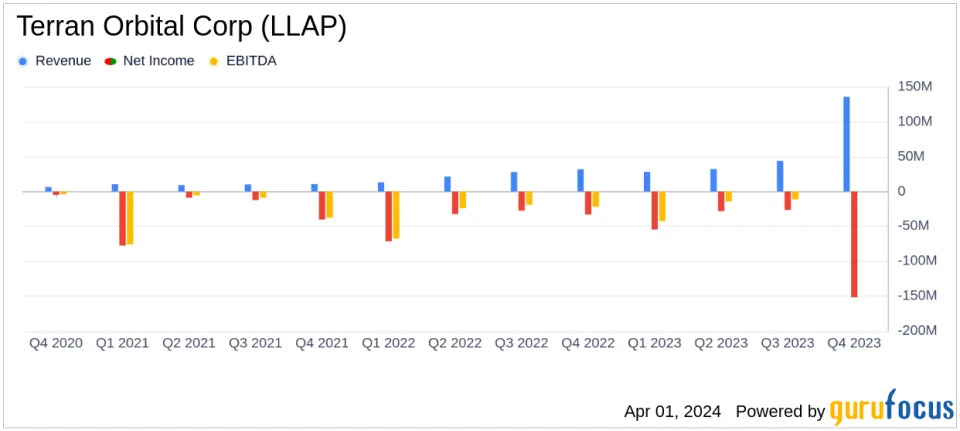

On April 1, 2024, Terran Orbital Corp (NYSE:LLAP) released its 8-K filing, announcing its financial results for the year ended December 31, 2023. The company, a vertically integrated provider of end-to-end satellite solutions, has reported a record revenue of $135.9 million, which is a 44% increase from the previous year and aligns with analysts’ revenue estimates of $49.702 million for the quarter. This performance is particularly noteworthy as it reflects the company’s successful execution of customer contracts and its ability to secure significant contract wins and modifications.

Financial Performance and Strategic Initiatives

Terran Orbital Corp’s gross profit turned positive at $8.6 million, a remarkable recovery from the prior year’s gross loss, indicating an effective cost management and operational efficiency. The net loss has been reduced to $151.8 million from $164 million, showing the company’s progress towards profitability. The company’s cash balance stood at $71.7 million, providing a solid foundation for future growth.

The year 2023 was marked by strategic milestones for Terran Orbital Corp, including the manufacturing of 78 satellites for Lockheed Martin for Space Development Agency programs and the introduction of seven new standard bus designs. The company’s new Responsive Space Initiative, aimed at delivering standard buses in 30 days and integrated payloads in 60 days, highlights its commitment to innovation and customer responsiveness. The commissioning of the new 50 Tech facility and the groundbreaking of the Goodyear expansion facility are indicative of the company’s expansion and scaling efforts.

Challenges and Opportunities

Despite the positive revenue and gross profit, Terran Orbital Corp faced challenges, including a net loss and Adjusted EBITDA of $(77.4) million for the full year, which was primarily due to an increase in selling, general, and administrative expenses as a result of growth initiatives. The company’s backlog, however, presents a significant opportunity, with $2.7 billion as of December 31, 2023, of which $2.4 billion is related to Rivada Space Networks.

Marc Bell, Co-Founder, Chairman, and Chief Executive Officer, expressed confidence in the company’s strategic direction, stating,

Our revenue growth and gross margin improvement affirm the strength of our strategy and execution. The future of space is responsive, and Terran Orbital is well-positioned to capitalize on this growing market segment.”

Financial Statements Highlights

Key details from the financial statements include a year-end cash balance of $71.7 million and gross debt obligations of approximately $313.8 million. Capital expenditures for the year totaled $23.1 million, reflecting ongoing investment in the company’s growth. The company’s balance sheet indicates a shareholders’ deficit of $(157.636) million, which will be an area to monitor as the company continues to grow and manage its capital structure.

The importance of these financial metrics cannot be overstated for a company in the Aerospace & Defense industry, where capital-intensive projects and long-term contracts are the norms. Revenue growth, cash balance, and backlog are critical indicators of the company’s ability to fund its operations, invest in new technologies, and fulfill its contractual obligations.

In conclusion, Terran Orbital Corp’s 2023 financial results demonstrate significant progress in revenue growth and strategic developments. While the company still faces challenges in achieving profitability, its record revenue, improved gross profit, and substantial backlog position it favorably in the competitive aerospace and defense industry. Investors and stakeholders will be watching closely as the company continues to execute its growth strategy and works towards sustainable profitability.

For more detailed information and analysis, readers are encouraged to view the full 8-K filing.

Contact information for Terran Orbital Corp is available for investors seeking further details at ir@terranorbital.com or by phone at 949-202-8476.

Explore the complete 8-K earnings release (here) from Terran Orbital Corp for further details.