Today’s Stock Market in 2-Minutes

July 7, 2025

With a game changing product and a total addressable market of over $37 billion, investors are watching this category pioneer very closely

For decision makers in regulated industries, it can sometimes feels like complex legislation is an insurmountable obstacle.

That’s why FiscalNote (NYSE:NOTE) is combining human insights and the power of AI to simplify regulatory compliance and help get more done faster.

Regulations are complex and getting worse, making it extremely difficult to get things done, especially in regulated industries. FiscalNote has a powerful and innovative solution.

To put it simply, nobody else is doing this, and FiscalNote has a huge head start on any would-be competitors.

Regulations are complex, long, and constantly changing. With its proprietary AI technology, FiscalNote makes quick work of tasks that would seem insurmountable to human workers.

FiscalNote delivers actionable insight to decision makers who need it most. It helps ensure compliance and allows decision makers to easily navigate an increasingly complex regulatory environment.

Regulation touches almost every business, industry, and agency these days. The market for something like FiscalNote that makes sense of the chaos is large and growing.

The regulatory environment, already very complex, is only expected to get worse as more industries are regulated and changes are made to existing regulations. It is becoming nearly impossible for decision makers to keep up with, and that’s unlikely to change any time soon.

FiscalNote has clients across all sectors of industry and government, over 5000 organizations currently, including major corporations and the Executive Office of the President of the United States.

Based on the above, it should come as no surprise to hear that FiscalNote is growing, both in terms of clients and revenues. This is a classic case of being in the right place at the right time, and FiscalNote has the right product for what the market needs now.

Like it or not, regulation and legislation has reached a level of complexity that makes even what should be a simple task or decision exceedingly difficult.

Decision makers now have to consider all the legal implications, current and future, of every decision, often without good information about current policies, and certainly not what’s coming in the future.

This problem is only getting worse, and the team at FiscalNote decided to do something about it.

Chaos may be a strong word here, but ask anyone who has tried to do this type of work recently, and they’ll tell you if anything it’s an understatement. The levels of complexity are growing fast, and even for experienced professionals, there’s a lot to keep track of.

Old methods simply can’t keep up. With FiscalNote, decision makers get the information they need, easily accessible, with all the tedious background work done for them. The system sorts through the data, analyzes regulations and their implications, and presents the information in a way that lets leaders do what they do best; make decisions.

In a recent survey, more than a third of surveyed global CEOs reported that regulatory and policy issues are the biggest threats to their businesses. With the scope and the importance of this problem, it’s easy to see the market potential for someone who comes along and solves it.

That’s exactly what FiscalNote has done, and as both the leader and pioneer in this innovative new market, they’re set to reap the rewards.

These days it seems that everybody is talking about AI, and while some of the projects seem a bit absurd, what FiscalNote is doing makes a lot of sense.

Computers have always helped humans with boring and tedious work, starting with mathematical calculations, and now moving into other, less technical disciplines. One of the most promising of these is the legal and regulatory space, where long, boring, tedious work has historically been the backbone of every major decision and action.

Without going too deep into the boring, technical details, FiscaNote’s innovative platform streamlines and automates the most tedious parts of the job, collecting, ingesting, and processing data and turning it into actionable insights for decision makers.

The system was built to handle complexity, the kind of thing that would push human analysts to the breaking point.

The platform is scalable, based on modern cloud technologies, and integrates with existing systems. It works with decision makers, handling the tasks computers do best and freeing people up to make decisions, not process data.

This is the sentiment across FiscalNote’s user base, and between the time and cost savings, predictive modeling, and streamlined compliance and insights, the value proposition is clear.

Almost every business and government agency has to deal with complex regulations at some point, and for many of them, this is a daily occurrence. Anything that streamlines the process, ensures compliance, and makes decisions faster, easier, and more accurate is going to be in high demand.

The potential market for this is huge, estimated at over $37 billion for legal and regulatory information services. As we’ve seen, FiscalNote is the pioneer and the leader in this space, and its impressive list of clients proves the demand is there.

As you can see in the image above, some very big names already trust FiscalNote to make their jobs easier. From major financial institutions, energy companies, healthcare providers, and even the CIA, decision makers trust FiscalNote for important, life and death matters.

Regulation is here to stay, and a growing number of companies and agencies are realizing they need to do something about it, allowing them to remain in compliance while also acting quickly and decisively when it matters most.

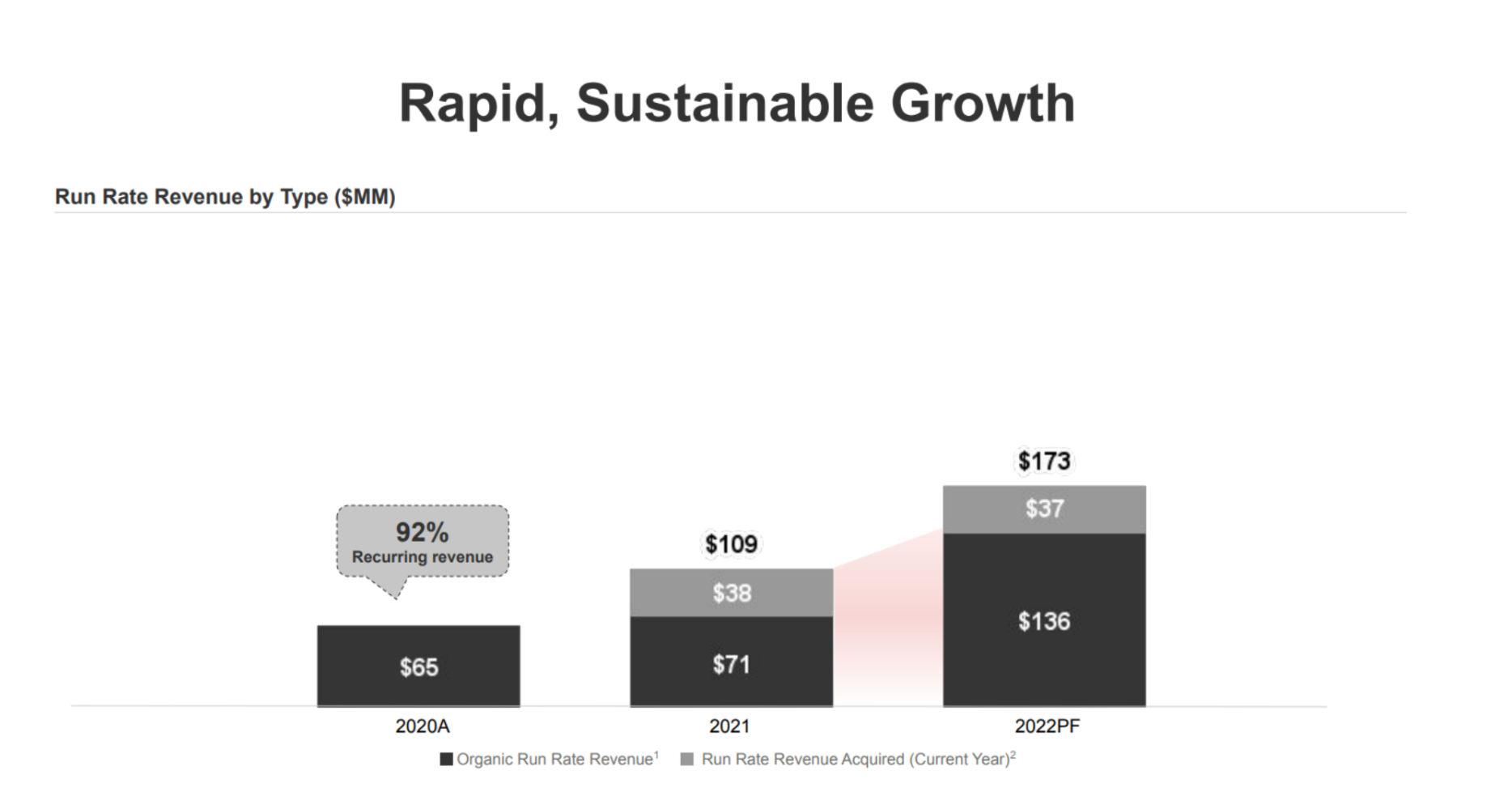

Given what we’ve seen so far about the problems complex regulations create and how well FiscalNote works to alleviate these problems, it should come as no surprise to investors to see a solid history of rapid revenue growth.

From $65 million in 2020, FiscalNote has grown to over $173 million revenue so far in 2022, an impressive 2.6x increase. Driven by a subscription-based SaaS business model, over 90% of revenue is contracted and recurring, with clients who rely upon FiscalNote for their most critical work and decisions.

And as much as we’ve already seen the company grow, this could be just the beginning of something much bigger. The problem FiscalNote solves is important, nearly universal, and only getting worse. The company leads the field, and its results show that more people are realizing this all the time.

Regulatory complexity is a major and growing problem. From government to finance, industry to healthcare, the sprawling web of legislation and compliance is taking its toll, paralyzing decision makers who often don’t even know where to begin.

FiscalNote’s innovative platform, the first of its kind and pioneer of a whole new category, cuts through the chaos, wades through the endless sea of data, and presents end users and decision makers with simple, actionable insights they can use.

Already trusted by over 5000 customers, including government agencies and major companies doing critically important work, this could still be just the beginning of the story of FiscalNote’s rise to the top.

Regulation touches nearly everyone, and as complexity grows, so does demand for something to make sense of it all. FiscalNote is the name people trust, and its rapidly growing revenues reflect that.

As big as the last few years have been for the company, this might be just the beginning. There’s over $37 billion of potential market out there for this kind of service, and FiscalNote is at the forefront of the race to capture it.

For investors, this could be a great opportunity to get in on the ground floor with a company solving one of the biggest problems of the modern age and helping the most important work get done.

FiscalNote trades under NYSE:NOTE.

In his time at FiscalNote, Tim has raised more than $230 million in venture capital and acquisition financing from the likes of The Economist, S&P Global, Mark Cuban, Jerry Yang, Steve Case, NEA, and others.

Prior to founding FiscalNote, Tim began his career in politics on the Obama ’08 campaign. He was elected to the Montgomery County Board of Education a year later, overseeing a budget of over $4 Billion for 22,000 public employees. As a high school student, Tim also served as the President of the National Youth Association and the founder of Operation Fly. Inc., – a national 501(c)(3) organization that served inner-city children in underprivileged areas around the country.

A graduate of Princeton University, Tim was profiled in Forbes 30 Under 30, Inc. 30 Under 30, Washingtonian’s Tech Titans, Goldman Sachs 2020 Builders and Innovators, CNN’s Top 10 Startups, and Business Insider’s Top 25 Hottest Startups. He is currently a World Economic Forum Technology Pioneer, a trustee on the Board of the Greater Washington Community Foundation (the largest funder of non-profit and philanthropic initiatives in the DC region), a Board member of The After School Alliance, and a member of the Council of Korean Americans (CKA).

Gerald guides strategic and corporate culture initiatives. He co-founded FiscalNote after a decade leading operations in the non-profit, public schools, and start-up sectors. He is currently Chief Strategy Officer, Global Head of ESG, and a member of the board of directors, overseeing international expansion and leading FiscalNote’s corporate responsibility program. Previously, Gerald was director of finance for the National Youth Association.

He studied finance and sociology at Emory University.

Jon is the Chief Financial Officer and Chief Investment Officer at FiscalNote, with three decades of experience as an investor, operating executive, and board member at high-growth, business intelligence, data, and SaaS workflow companies. He is responsible for investor relations, internal and external financial reporting, executing the company’s M&A strategy, oversight of accounting compliance, and managing capital allocation and growth.

Prior to joining FiscalNote, Jon was the Managing Director of UCG, a private holding company of 10 leading business-to-business information, data, and workflow SaaS companies serving the energy, healthcare, telecommunications, financial services, technology, advertising, and tax preparation markets. At UCG, he managed mergers, acquisitions, divestitures, debt and equity financings, strategic and business planning, budgeting, operations, and governance – completing and integrating over 30 strategic acquisitions for the portfolio.

Earlier in his career, Jon was a Co-founder and Managing Director of MCG Capital, a senior debt, mezzanine, and uni-tranche investment company – backed by Goldman Sachs, Heller Financial, Vestar Capital Partners, and Soros Private Equity Partners – which became a publicly-traded Business Development Company (BDC) during Jon’s tenure. Jon originated and managed investments in information, software, and media companies while at MCG.

Jon holds a BA from Denison University and an MBA from the University of Virginia’s Darden School of Business Administration.

Josh is FiscalNote’s President & Chief Operating Officer with more than twenty-five years of experience as an executive, attorney, and business leader in both startup and established corporate environments.

As President & COO, he is responsible for managing corporate operations, including the Commercial, Business Development, Marketing, Content, and People functions, as well as providing coordinated oversight over FiscalNote’s diversified lines of business and ensuring optimal allocation of resources to drive efficient revenue growth.

Josh also has served as FiscalNote’s General Counsel, in addition to leading the full-suite of global content solutions as Chief Content Officer. As General Counsel, he has successfully navigated and managed the company’s complex legal and regulatory processes, as well as its robust and accelerated M&A and financing initiatives, and built a high-performing Legal department. In his role as Chief Content Officer, Josh serves as Publisher of CQ Roll Call, oversees FiscalNote’s EU-based policy analysis, and has managed the company’s expansion further into political and economic intelligence with its recent acquisitions of Oxford Analytica and FrontierView.

Prior to joining FiscalNote, Josh was a senior executive and member of the Board of Directors of Spree Commerce, serving as COO/General Counsel and helping lead the company to a successful acquisition by First Data Corporation (now Fiserv). Prior to Spree Commerce, he led the Digital division of Gannett, and was a senior in-house attorney at AOL. Earlier in his career, he spent several years in private law practice representing clients in the TMT sector in corporate transactions and regulatory matters.

Josh has been twice named to Washingtonian Magazine’s “Tech Titans” list, in 2019 and 2021, has advised numerous tech startups as well as a venture capital firm investing in the tech and media ecosystem, and has served on multiple Boards of Directors. He holds a B.A. from the University of Pennsylvania and a J.D. from Boston University School of Law, where he was named an Edward F. Hennessey Distinguished Scholar and G. Joseph Tauro Scholar, as well as earning the Dean’s Award in Communications Law.

Todd is a strategic and collaborative attorney who brings to the company over 10 years’ experience advising public and private company clients. As our Senior Vice President, General Counsel, and Secretary, he oversees FiscalNote’s legal affairs, including corporate governance, securities compliance, employment law and compensation matters, litigation, financings and other strategic transactions. He also oversees the company’s compliance function, including ethics, data privacy and the development and implementation of corporate policies.

Before joining FiscalNote, Todd was Associate General Counsel – Corporate and Securities and Assistant Secretary for FLIR Systems, Inc., a publicly-traded international sensor technology company. Prior to joining FLIR, Todd served as Assistant General Counsel and Assistant Secretary at Gannett Co., Inc., a publicly-traded media and marketing solutions company, through its acquisition in 2019. Before then, Todd was a senior associate in the SEC Advisory and Capital Markets practice groups at Hogan Lovells US LLP.

Todd holds a JD, magna cum laude, and an LLM in Securities and Financial Regulation, with distinction, from the Georgetown University Law Center, as well as a BA in Political Theory and Religious Studies from the University of Virginia.

Sara Buda is the Vice President of Investor Relations for FiscalNote. She brings more than 20 years of investor relations, communications, and corporate development experience with a background in establishing proactive, best-in-class investor relations programs. Buda serves as FiscalNote’s primary contact for investors, analysts, and shareholders. Her main responsibilities include: analyst and investor communications and engagement; educating and informing the global investor community about the company’s financial performance, growth prospects, and M&A strategies; management of our quarterly corporate earnings process; increasing investor and analyst interest in the company as a long-term investment opportunity; investor conference participation; ongoing analysis of investor and market sentiment and stock performance; and, international investor engagement.

Prior to joining FiscalNote, Sara was Vice President Investor Relations for Berkshire Grey (Nasdaq: BGRY), an emerging leader in AI-enabled robotic solutions. Previously, Sara was Vice President of Investor Relations for Boston Properties (NYSE: BXP), the largest publicly-traded developer and owner of Class A office properties in the United States. Sara’s experience also includes serving as Senior Vice President of Investor Relations and Corporate Development for Lionbridge Technologies, a publicly-traded technology services company, where she grew the company’s shareholder base, established the company’s corporate development function, and played a key role in the ultimate sale of the company to H.I.G. Capital.

Sara holds a Bachelor of Science degree from Syracuse University.

Laurie leads Product Management, Design, and Professional Services at FiscalNote. She brings nearly 20 years of product innovation and development experience across enterprise organizations, midsize companies, and startups. Laurie has deep experience in building and servicing both B2B and B2C products across multiple industries, including Education, Healthcare, Renewables, and Media.

Prior to joining FiscalNote, Laurie built a Product and Design team at CleanChoice Energy, serving as Chief Product Officer. Before that, she led Product at Knowledge to Practice, and the Innovation team at Hobsons, where she was responsible for identifying, building, and commercializing promising new products.

Laurie focuses on building empowered product teams, continuous process improvement, and the iterative lens of ensuring product/market fit.

Paul is FiscalNote’s Chief Accounting Officer and leads the Accounting and Finance team responsible for all internal and external financial reporting. He brings to the company nearly 20 years’ experience in providing capital markets accounting advice to clients throughout the public company lifecycle. That experience includes guiding companies through the technical accounting and financial reporting requirements related to mergers and acquisitions, private debt offerings, recapitalizations, application of new GAAP pronouncements, and SEC reporting.

Before joining FiscalNote, Paul was a Managing Director at Riveron, an accounting advisory firm, where he led the mid-Atlantic capital markets practice. Prior to Riveron, Paul was a Director in the Deals practice of PwC where he provided large private equity clients, portfolio companies, and corporations with M&A and capital markets accounting advice.

Paul holds a BS in Accounting from Greenville University and is a licensed CPA in IL and VA.

Vlad currently leads the AI Research team at FiscalNote, focusing on using machine learning and natural language processing (NLP) to create practical applications for analyzing, modeling, and extracting knowledge from the growing amount of mostly unstructured data related to government, policy and law. He created the first version of the company’s patented technology to help organizations understand and act on policy changes. He has more than a decade of experience developing state-of-the-art machine learning algorithms for a broad range of NLP applications including entity extraction, structured prediction, machine translation, text classification, and information retrieval.

His work has led to 10 patent applications, he has published more than 20 peer-reviewed papers in and serves on the program committees for top-tier conferences, such as ACL, NAACL, and EMNLP, and has been covered by media such as Wired, Vice News, and Washington Post. His research awards include the National Science Foundation Graduate Research Fellowship and the National Defense Science and Engineering Graduate Fellowship, and he has conducted research in academia (Columbia University, Johns Hopkins University, University of Maryland), industry (Raytheon, BBN Technologies, JHU Applied Physics Laboratory), and government.

Vlad completed his Ph.D. in Computer Science with Philip Resnik at the University of Maryland, and his B.S. in Computer Science and Philosophy at Columbia University.

With more than 25 years of career experience spanning the corporate, government, journalism, and agency sectors, Nicholas leads the full suite of mission-driven corporate communications programs for FiscalNote – including all media relations, executive & internal communications, brand reputation, and influencer engagement programs – and also manages the company’s public affairs presence in the marketplace.

Prior to FiscalNote, Nicholas was Founder of Hidden Creek Communications, a public relations consultancy with a global clientele of Fortune 500 companies, start-ups, and advocacy organizations including Gannett, Accenture, Consolidated Edison, USA Today, and the American Foundation for Equal Rights. He was also Executive Editor of The Loudoun Times-Mirror, where he earned eight awards for his journalism from the Virginia Press Association. In the corporate domain, Nicholas was Vice President of Communications and Spokesperson for America Online (AOL), and also held the same position at IAC/InterActiveCorp’s flagship Ask.com unit at transformational times for both brands.

A strong believer in public service, Nicholas was Press Secretary for the President’s Commission on Care for America’s Returning Wounded Warriors, where he received the Award for Outstanding Achievement from the U.S. Secretary of Defense. During his time in the U.S. House and U.S. Senate on Capitol Hill, Nicholas served as Press Secretary for U.S. Senators Olympia J. Snowe (Maine), John H. Chafee (Rhode Island), and the Senate Environment & Public Works Committee. He was also senior policy advisor for the successful 1996 election campaign of U.S. Senator Susan M. Collins (Maine). He began his career working for an international PR agency in Washington, D.C., and a financial communications firm in London, UK.

Nicholas earned a BA in Political Science and Western Europe Studies from The American University’s School of International Service. He lives in Hillsboro, Va., with his wife and four sons – and loves to head up to his rustic log cabin on the Kennebec River in Maine any chance he gets.

With more than two decades of experience across a variety of organizations and industries in leading, managing, and inspiring teams and the HR operations which support them, Vibha manages FiscalNotes Global People function and drives strategies around enterprise change management, diversity and inclusion, talent acquisition and retention programs, compensation and benefits, training and career development, and ensures our People are appreciated, valued, and purpose-driven.

Prior to FiscalNote, she served as Vice President, Human Resources & Chief Talent Officer at Cogent Communications of Washington, D.C., a publicly traded, global internet service provider with a highly diverse team of 1,200 employees. From 2017 to 2021, Vibha was Vice President, Human Resources for the Graduate Management Admission Council (GMAC), a global, mission-driven association of leading graduate business schools, and owner and administrator of the GMAT exam, where she provided strategic oversight of all HR functions. Before Cogent and GMAC, she held executive-level HR positions at WETA, a public broadcasting station; Conservation International, a nonprofit environmental organization; Octagon, a global sports and entertainment content marketing company; and Discovery Communications, a global media company. Earlier in her career, Vibha served in HR roles at The Nature Conservancy and Goldman, Sachs & Co. In 2019 and 2021, she was named “HR Leader of the Year” in the Washington, D.C. market, and was recipient of the 2021 inaugural Stephen Battalia Award for Excellence in HR.

She holds a BA in Political Science from the University of Connecticut, and an MBA in Management and International Business from the Leonard N. Stern School of Business at New York University.

Krystal oversees marketing, thought leadership, and community at FiscalNote to help customers and prospects better turn insights into action. She brings more than 20 years of diversified marketing, branding, and business development experience across both enterprise organizations and startups. Krystal also serves as the general manager for FiscalNote’s Community business, leading the vision and strategic direction of Board.org and the FiscalNote Executive Institute (FNEI).

Before joining FiscalNote, Krystal ran demand generation at EAB. Prior to that, she was Vice President of Marketing at Localist in Silver Spring, Md., ran marketing for PBS’ education division, and has had a variety of roles in previous marketing departments at Discovery Communications, TrustArc, BearingPoint, and CEB.

She holds an MBA from the Ross School of Business at the University of Michigan and a BS from Tulane University.

Mike is FiscalNote’s Chief Information Officer and Senior Vice President of Global Operations, responsible for managing FiscalNote’s administrative, facility, information technology, and security operations. Since joining the company in 2013, he has shepherded FiscalNote’s growth from an employee headcount in the single digits and a small office in Maryland to roughly 800 full-time staff and a corporate footprint consisting of 135,000+ square feet across the United States, Australia, Belgium, India, Singapore, South Korea, Taiwan, and the United Kingdom.

Mike has served in multiple capacities at FiscalNote – most recently as Chief of Staff and Head of Corporate Communications – as well as Head of both the People and Client Support & Implementation departments. He drove multiple original initiatives such as recruiting and hiring, training and education, performance management, and organizational development. In 2016, Mike was selected to represent the District of Columbia’s tech, creative, and business community as an Ambassador to South by Southwest Interactive. He has worked closely with the District of Columbia’s Mayor’s Office as a representative of FiscalNote on multiple initiatives, and was responsible for its negotiations to keep FiscalNote’s headquarters in the district in 2017. He oversaw the planning and execution of FiscalNote’s successful communications strategy surrounding its historic $180 million acquisition of CQ Roll Call in 2018, as well as other critical funding, acquisition, and corporate news events. In 2021, Mike played a critical role in the planning and preparation for FiscalNote’s public markets entrance, as well as the communications and integration planning of its numerous acquisitions that year.

Mike came to FiscalNote with a background in independent school education, both as an administrator and teacher, having taught history, government, and math. He holds an MS in Applied Economics from Johns Hopkins University, and a BSBA in Business Administration and Economics from the University of Richmond.

Patti Zack is responsible for leading FiscalNote’s delivery of a more seamless and impactful end-to-end journey for its customers, ensuring they experience the full value of their solutions. Patti brings nearly 15 years of diverse experience across sales, operations, compliance and management across the financial and information services industries. Most recently, Patti served as Director of Customer Success at Refinitiv, a global provider of data and analytics, where she was responsible for the successful retention of over USD 250 million in annual recurring revenue.

Passionate about improving the customer experience to grow revenue, Patti is adept at integrating cross-functional leadership teams to drive customer-focused, strategic initiatives. As a seasoned expatriate with a proven track record of developing robust teams at scale, she has led teams in Europe and North America by relentlessly focusing on data-driven decisions in environments of consistent transformation and resource constraints.

Patti holds a B.S in Economics from Purdue University and an MBA specializing in strategic management from the University of Notre Dame. When she’s not focused on customers, Patti enjoys traveling, cooking and tennis. Fun Fact: She’s been to 56 countries.