CURASCIENTIFIC NEGOTIATING $150M CONTRACT TO PRODUCE KAVA EXTRACT IN PALM DESERT LAB

June 23, 2023

Why Silo Wellness is the Best Hedge in this Red-Hot Market

Silo Wellness (CSE: SILO | OTC: SILFD | FRA: 3K70) is, quite simply, the next big thing in the psychedelic space. In fact, with the Marly One brand partnership, and a growing wave of attention from the mainstream press, one could argue it might already be the biggest thing you haven’t heard of. Yet.

Silo is a global psychedelics and wellness company, delivering psychedelic healing through functional mushrooms (no-trip) and healing retreats (yes-trip). Oh, and did we mention that it is already generating revenue? Because it is. Silo provides services in two countries, has global product distribution, and its partnership with the Marley One brand portfolio all generate revenue NOW, while also boosting Silo’s global footprint.

We’ll get to the specifics momentarily, but the TLDR is this: while most psychedelic companies you hear about are waiting on government funding or stuck behind red tape, Silo is already generating revenue and gobbling up market share.

All this while a wave of public awareness is coming to the legal psychedelics space. A quick sweep of the internet provides a deep dive into the business and culture of psychedelics, with Silo being prominently featured by mainstream publications like Outside Magazine, Forbes, Buzzfeed News, and more. The Silo name is already climbing the public awareness list in a blossoming market. It’s in the title for a reason: this company is your best hedge against the psychedelic companies that rely on a novel-compound to be approved for pharmaceutical use.

https://www.silowellness.com/psychedelic-revenue-now-monetizing-the-marley-opportunity/

Many psychedelic companies are involved in multi-year processes that result in a massive cash burn, with any revenue potential years down the road. Silo is different. Because of their approach to wellness, they have already been generating revenue. This proof of monetization via product sales, wellness retreats, and partnerships gives Silo an edge in the marketplace that can’t be ignored.

Without a key differentiator, most products get lost in the shuffle. Again, Silo has proven to be ahead of the competition. Its partnership with the Marley One brand, and relationship with the Marley family, makes Silo’s products the most recognizable in the game. Bob Marley is undoubtedly one of the biggest names in music history, and his legacy remains strong, with over 1B song downloads in the U.S. alone, while the Marley brand boasts a 70M strong social media presence. When Silo announced the partnership with Marley One, it generated over 22M earned views, and its footprint only continues to grow. Having a powerful, recognizable brand is one of the best ways to ensure long-term success, and Silo has found that in Marley One.

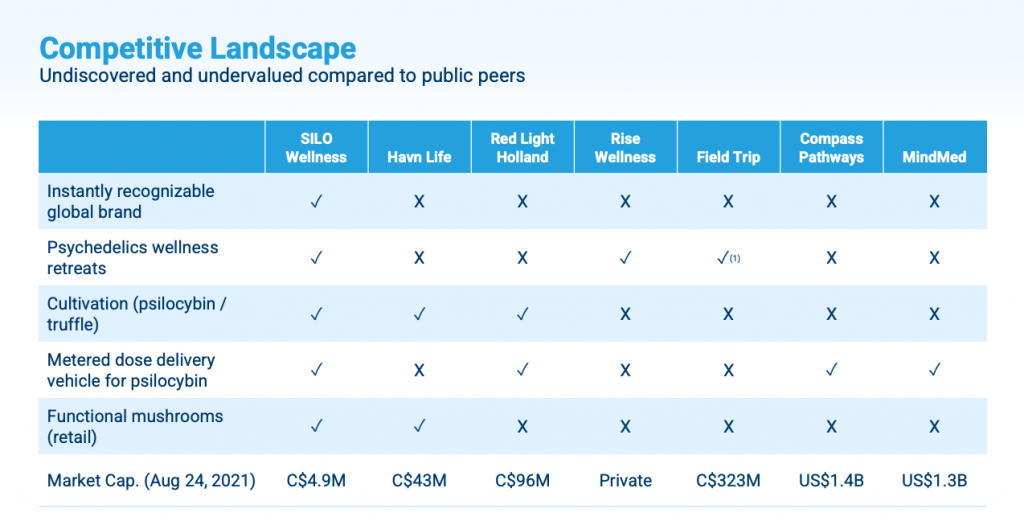

Silo is definitely not the only company in the psychedelic wellness space. And while it isn’t necessarily a crowded room, it’s a room filled with big players. Mind Med and Field Trip both have a market cap of a little over $1B, and most of Silo’s competitors boast caps 10x or more their own (roughly $5M at the time of this writing). In some ways, this is good news for potential investors, as this is your chance to get on the train before it leaves the station.

With its recently announced acquisition of Dyscovry Science, Silo’s investors will gain access to a government recognized pharmaceutical company using psilocybin and its derivatives to treat a physical condition (Irritable Bowel Syndrome) in addition to the existing mental health side of the business.

Silo has, smartly, diversified their approach to providing healing. It currently offers legal psychedelic retreats (ketamine in Oregon, and Psilocybin and 5-Meo-DMT in Jamaica), functional (read; no-trip) mushrooms via the Marley One partnership,their own line of mushrooms, a patent-pending psilocybin nasal spray, and mushroom cultivation. The big takeaway here is that Silo is not dependent on approval for the use of a novel molecule; it is scaling as legislation changes, and it is focused on the direct application of what is currently legal. This approach will give Silo the upper hand as they will not be wholly reliant on one area of revenue to succeed.

Among 35-55 year olds, especially in tech/start-up type businesses, wellness retreats are extremely popular. Gone are the days of 5 day “empowerment” seminars. Today’s professionals want a luxury trip somewhere beautiful and safe to work on healing their inner-psyche. Silo is offering just that, and its earned media placements in publications like Bloomberg and the Washington Post have led to a pre-qualified pipeline with a mile-long waitlist. Each retreat Silo has run is fully booked and it is working to schedule more. This revenue stream is the future of both tourism and wellness.

An area of growing importance in the investment landscape is social consciousness. Is the company aware of the cultural importance of what many people view as sacred? In the case of Silo, yes. It is making efforts to integrate indigenous practices in its wellness retreats, emphasize the importance of giving back to the community, and giving credit to the cultures that originated these alternate wellness pursuits. From a purely optics standpoint, this gives Silo enhanced respectability, and plays well with its target audience.

Silo’s partnership with the Marley One brand provides great value to the brand. Two moves on the distribution side this year should add even more value that is hard to come by with industries moving into the realm of widespread legalization: consumer accessibility.

In August, Silo and One Light Enterprises announced a $3 million distribution agreement that made Marley One’s full line of mushroom products available to the American public. Two months later, Silo expanded its reach when Amazon.com listed the company’s portfolio of functional mushroom products on their retail platform. This alone made products available to more than 197 million people who reportedly visit the online marketplace each month — more than the entire population of Russia.

“From inception, our primary focus has been to broaden acceptance and support for the normalization of mushrooms and psychedelics and to make both available today, wherever possible, to help reduce trauma, enhance performance and create revenue in this burgeoning industry now. Our listing on Amazon, one of the largest e-commerce platforms in the world, takes us one step closer to that goal,” said CEO Douglas K. Gordon

It’s hard to pretend we’re not excited about Silo’s potential. So we won’t. We’re really excited. Silo is doing all the things we like to see in emerging companies: establish a stream of revenue, build a recognizable brand, create strong partnerships, have a clear vision, and do something a little different. When you take into account the projected growth for psychedelics, in conjunction with cultural trends, we think it’s possible Silo could go vertical any second.

Real quick, let’s talk about just how rich the soil is in the markets Silo is playing in. The global anti-depressant drug market was valued at $13.8B in 2016, and is expected to grow to $16B by 2023. Meanwhile, a 2017 poll showed 59% of U.S. consumers would consider using psychedelics as a treatment if diagnosed with a mental health condition for which it had been proven effective. That means by 2030, Silo is playing with a TAM worth roughly $8B in the antidepressant drug market alone. According to Mordor Intelligence, the global functional mushroom market was worth $25.4B in 2020 and is estimated to register a CAGR of 8.44% through 2026. All this while the market research predicts increased applicability for functional mushrooms beyond healthcare and pharma products over the long term.

Silo’s involvement in functional mushrooms, and the surrounding applications, represents over $400B of commerce. If it can capture even a small slice of these markets, it will become the biggest name in psychedelic wellness practically overnight. With the power of the Marley name behind it, Silo is positioned to grow quickly into a powerhouse provider within these markets.

Silo has been busy working on distribution deals for its range of functional mushroom products under the Marley One brand. After signing a multi-year licensing agreement with the family of legendary musician Bob Marley for the exclusive worldwide rights to produce, market, and sell products under the famous musician’s name, Silo Wellness dove right in.

Celebrity endorsements are always helpful. But there is something especially powerful about the association Silo now has with Bob Marley. Few performers have ever reached the kind of popularity that Bob Marley did, and even fewer have maintained (and even grown) their reach posthumously. Thanks to his family, Bob Marley’s legacy has remained strong.

“Our family is happy to collaborate with Silo Wellness to create the first ever global mushroom brand,” commented family matriarch Rita Marley in a recent press release. “When Bob and I were young we followed a strict, natural diet and we would include medicinal mushrooms. Mushrooms fit with our vision of a world transformed for good through natural products.” The initial launch of Marley One featured a range of functional mushroom tinctures with unique blends designed to offer a range of unique health and wellness benefits, from immunity and gut health to cognitive function and sleep enhancement. Silo is working to bring wellness to as many people as possible, and the Marley One partnership is already proving to be a move in the right direction. In mid-August, Silo announced a $3 million national distribution agreement with Texas-based distribution and advertising company One Light Enterprises LLC. for its portfolio of Marley One branded mushroom products across 47 U.S. states. This announcement came on the heels of a previous announcement that U.K. brand distributor LocoSoco Group Plc. had committed to a $1.4M minimum order of Marley one products. Not bad, considering that the Marley One brand only debuted earlier this year. Since then, Silo has also signed a distribution deal with the UK-based company, Flawless CBD Distribution, to further their mission to remove the stigma against the medical use of hallucinogens. The partnership with Flawless CBD Distribution also happens to coincide with the kickoff of the Bob Marley ‘One Love’ Experience at Saatchi Gallery, in Chelsea. The exhibition will showcase never-before-seen Marley photos and memorabilia while discussing the artist’s life journey, and will reside in Chelsea for ten weeks before embarking on a global, multi-city tour. All of this recent company news culminates as Silo Wellness begins a partnership with UVertz, a revolutionary advertising platform. This partnership will result in Marley One ads being displayed in 50 cars in NYC whose drivers utilize gig economy apps such as Uber and Lyft and is designed to increase brand familiarity, recognition, and confidence. As we mentioned earlier, the company has executed a nonbinding letter of intent to acquire Dyscovry Science, a Toronto-based biotechnology company that focuses on biosynthetic manufacturing of psilocybin and its derivatives. This is huge news for Silo Wellness, and the implications for investors could be game changing. Unlike most of its peers in the psychedelics space, which focus on mental health issues, Dyscovry is targeting a physiological condition: irritable bowel syndrome. In addition, the company has research collaborations with Canadian federal government research laboratories intended to further development of a biotechnological process for the production of psilocybin and its potentially novel molecule derivatives. This acquisition gives psilocybin and Silo Wellness more credibility, bringing natural healing solidly into the realm of exact science. Silo President and Founder Mike Arnold explained, “We have watched the psychedelic market get pummeled as many have been chasing the ‘me too’ pharma deals, while we stayed focused on preparing for Oregon adult-use with a successful Jamaican retreat model while, in the background, working on this unique opportunity. For the first time under one roof, a publicly-traded company will provide psychedelic healing right now through Jamaican psychedelic wellness retreats while at the same time innovating the ‘what’s next’ for psychedelic pharmaceutical healing.” Dyscovry CEO Gerard Lee added “By Dyscovry’s research team focusing on investigating a quantifiable anti-inflammatory effect of psychedelics, Dyscovry has embarked on the rigorous scientific investigation of enhanced biosynthesis of psilocybin, as an alternative therapeutic option to both naturally-occurring and chemically-synthesized psilocybin. The downstream goal is to bring regenerative medicine approaches to the treatment of IBS” This upcoming acquisition is major news for investors, as Arnold explained. “We believe we will be the only company with deep roots in Oregon that is actively providing psilocybin to paying guests in the western hemisphere (Jamaica) while at the same time working a pharmaceutical opportunity (Dyscovry). In other words, if the future of psychedelic medicine is a state-by-state legalization akin to cannabis, we intend to have you covered. If the future is pharma, we have an asset for you as well. If these parallel avenues go forward simultaneously with a thriving adult use market in addition to pharma, then freedom wins, and the world is better for it. We intend to be a leader in the space and hope to bring inexpensive psychedelic healing to as many people in need as possible.” With the steady legalization of marijuana, the attitudes toward other substances have begun to shift rapidly. Legal ketamine clinics are popping up all over the U.S. to treat depression, and it’s only a matter of time before psilocybin is legal for medical use as well. An article by the Observer indicates that legal psychedelics as a whole are forecast to be a $6.7B market by 2027. As the perception of these substances continues to change, Silo is perfectly positioned to dominate the space via stellar brand recognition. And they aren’t limited to psychedelics. The majority of Silo’s current product efforts are focused on the functional mushroom space. Mushrooms like Lion’s Mane, Chaga, Rooster Tail, and more have been proven to improve cognition, mood, and increase overall well-being. The future of psilocybin is promising, but in the meantime, Silo is advancing its interest in the functional space, currently worth $34B (and growing at a CAGR of 8%). Investors are catching on to the fact that psychedelics are going to be big. And Silo is set to deliver. In addition to a new media campaign in New York City, featuring targeted on-the-go ads in the windows of rideshare cars, it recently announced Marley One’s sponsorship of ‘For The Love of Hip Hop’ – a virtual concert series exclusive to the metaverse – with the first event of the series being held on February 11. This cutting-edge digital event marks a forward-thinking brand threading the needle between innovation and maintaining a connection to its core consumers. It’s this kind of strategy that has us excited about the future of Silo. “We’re thrilled to celebrate Marley One’s official arrival to the metaverse as a leading sponsor of ‘For The Love of Hip Hop’, a completely virtual concert series featuring a star-studded lineup of artists,” said Douglas K. Gordon, CEO of Silo Wellness. “As innovative first-movers in the psychedelics and functional mushroom categories, we’re always proud to support future-forward ventures – and the Marley One brand is forever married to music. From psychedelics to virtual reality, Marley One remains at the forefront of cultural moments and community events.” ‘For The Love of Hip Hop’ will bring all the functionality of the metaverse, offering an interactive virtual experience packed with wonderful visuals and sounds for all who attend. This unprecedented way to experience music will bring people together like never before, giving them front-row access to legendary hip hop artists. The New Age of Empowerment – Move Over Tony Robbins Mushrooms, microdosing, and other forms of alternative wellness are exploding in popularity among the 35-55 age groups, especially for those in startup/tech related professions. We all remember the “Unleash Power Within” Tony Robbins seminars. Walk across some hot coals and scream really loud, and maybe you’ll double your sales (or whatever). Silo is offering the newer, better, version of those. Silo is engaged in an interesting branch of treatment, labeled “psychedelic retreats”. It’s exactly what it sounds like. People go to a location (Jamaica for mushrooms, Oregon for Ketamine), where they are guided by trained professionals through a healing psychedelic experience. “We are prioritizing the expansion of our wellness retreat offerings to meet rising consumer demand for these transformative psychedelic experiences,” said Chief Executive Officer Douglas K. Gordon in a press release. “Setting and mindset have a profound influence on an individual’s experience, and our Jamaican retreats offer idyllic, natural backdrops for engaging in psilocybin-assisted exploration, introspection and self-actualization.” A study published in November 2020 by Research and Markets valued the overall wellness tourism industry at $735.8B; by 2027, the agency projected it would be worth $1.2T. Silo’s ventures into this space have been successful so far, with more wellness retreats planned as legalization spreads. So what does a psychedelic retreat look like? The Renew Your Purpose retreat in early 2022 was a five day, four night psilocybin-assisted seminar, of sorts, in which guests participated in activities led by author Jessica Huie. Huie’s book Purpose served as a bit of a syllabus for the activities, helping participants focus on self-reflection and purpose. “I felt like a neural pathway in my brain had opened up. There was a release,” said Whitney Leming-Salisbury, a Renew Your Purpose retreat participant from the United States. “The combination of yoga, ceremonies, the workshops and one on one sessions with the guides, really solidified my integration with the medicine.” “This is why we do what we do,” said CEO Douglas K. Gordon, “to safely introduce individuals to psychedelics in a legal place in the western hemisphere.” Providing an atmosphere and experience for psilocybin treatments is one thing, but Silo is also actively working at delivery methods through product innovation. In April 2021, the company signed a LOI for a multi-year patent licensing agreement to exclusively manufacture, promote, advertise, distribute and sell Jungle Med’s patent pending, metered-dosing psilocybin nasal spray in Colombia and Brazil. The IP has great potential in the psilocybin market, as it delivers treatment in an alternative and effective way. While mushrooms are typically digested like any other food, the metered-dosing nasal spray provides an accurate dosage — something eating can’t accomplish — and creates a quicker uptake. This faster uptake speed is critical to preventing accidental stacking of doses, similar to the problem of cannabis edibles, and it brings some much-needed innovation to how people ingest psilocybin. So, you’ve read some numbers and see that all signs point to growth in the psychedelics space. But why Silo? Well, any growing company can make smart investments, secure strong partnerships, and make all the right marketing moves. But you can’t just buy the type of good press Silo is receiving. Mainstream media outlets are highlighting the psychedelics cultural movement with in-depth storytelling — a useful tool for psychedelics to earn public favor in the health and wellness field. But beyond driving interest in the culture at large, names like Bloomberg, The Washington Post, Outside Magazine, Buzzfeed News, and others are turning specifically to Silo for their reporting. The brand is being placed in the forefront on this ride to public awareness. Buzzfeed’s John Semley penned a lengthy narrative feature detailing his experience with 5-MeO-DMT during a wellness retreat this year. In it, Semley joined one of Silo’s retreats in Montego Bay and gave a detailed and highly informative account of his experience with “The God Molecule.” David Kushner of Outside Magazine examined Silo’s approach to treating mental illness and its work with ketamine and psilocybin, declaring that the “future of nature therapy is psychedelic.” Could they really be a radical new way to solve mental health problems?” Kushner asks. “A lot of serious people, including activists and research scientists, believe there’s potential to develop important techniques that really contribute to healing.” Kushner points out that Silo received more than 100 inquiries for just five spots in the retreat he observed, suggesting there is already a flood of demand for what Silo offers. Silo announced in early 2022 that its popular subsidiary Marley One would be a headline sponsor of ‘For Love and Hip Hop,’ an innovative concert held in the metaverse — yes, in the metaverse. The company is certainly getting creative with their marketing, and gaining brand recognition while piggybacking on the popularity of another cultural trend, festivals, shows some ingenuity. The festivals and events industry will be worth an estimated $2.19 trillion by 2028, riding an impressive 13.48% CAGR. Silo’s magic is in the experiences it’s creating for customers. An innovative concert in the multiverse here with the Marley One banner headlining it all. Personal, intimate psychedelic wellness retreats plugging into a burgeoning new vacation culture there. Looking at Silo as more than a company moving products off of shelves reveals multiple revenue streams into the future. Silo Wellness is, quite simply, in the sweet spot for massive growth. It is revenue generating, has the power of multiple trends behind it, boasts a diverse portfolio of products and offerings (almost all of them already providing revenue), and arguably has the largest social footprint and brand recognition of anyone in the space. Moreover, Silo is vastly undervalued when compared to the competition, and the pending acquisition of Dyscovry Science has the potential to bring psychedelic wellness squarely into the realm of exact science by treating physical conditions as well as mental.The rapid expansion of the Marley One brand will be driving growth in the short term, with the U.K. and U.S. distribution deals already in place. Silo will also be releasing their own branded product line in the same vein, while endeavoring to open brick and mortar mushroom shops as legislation allows. Its business is a big one, with hands in multiple avenues of healing. The bottom line is, especially with the acquisition of Dyscovry, we think that Silo Wellness won’t be undervalued much longer. Chief Executive Officer Chief Financial Officer Legal Counsel and Corporate Secretary

Psychedelics meet Pharmaceuticals

Mushrooms are Growing (in Popularity)

![]()

Bringing Innovation to the Product Sector

The Press Loves Silo (and the Psychedelic Movement)

Is an Innovative New Sector of the Festival Culture Boom Brewing?

Make Room for the Shroom Boom

Recent News and Press Releases

![]() Psychedelics Co. Silo Wellness To Acquire Dyscovry Science, Seeking To Leverage Its Govt. Partnerships

Psychedelics Co. Silo Wellness To Acquire Dyscovry Science, Seeking To Leverage Its Govt. Partnerships![]() Buzzfeed News: I Wanted Ego Death. This Powerful Psychedelic Gave It To Me

Buzzfeed News: I Wanted Ego Death. This Powerful Psychedelic Gave It To Me![]() Outside Magazine: ‘Camping With Ketamine,’ Featuring Silo Wellness

Outside Magazine: ‘Camping With Ketamine,’ Featuring Silo Wellness![]() Marley One Launches The First Global Functional And Psychedelic Mushroom Brand

Marley One Launches The First Global Functional And Psychedelic Mushroom Brand![]() All-Inclusive Magic Mushroom Retreats Are the New Luxury ‘Trips’

All-Inclusive Magic Mushroom Retreats Are the New Luxury ‘Trips’![]() Shroom products designed with Bob Marley’s family bound for UK shelves

Shroom products designed with Bob Marley’s family bound for UK shelves![]() Psychedelic Mushroom Shops Reach The Americas

Psychedelic Mushroom Shops Reach The Americas![]() Will psychedelic mushroom vacations come to the U. S.?

Will psychedelic mushroom vacations come to the U. S.?Press Releases

Management

Douglas K. Gordon

Winfield Ding

Kenny Choi